May 11, 2023

The concept of the property ladder in Real Estate is simple. A buyer starts with a “starter home” at a younger age, then moves up to a bigger house as say, their growing family needs that. There may be another move up into an even larger home as kids age, school choices change, etc. This might be the “forever” home. At some point then, there may be a down-sizing into a condo or a smaller house. For a textbook property ladder, you may have 3-5 homes owned by a single buyer over their life, each one serving a different purpose. It’s a concept that makes sense when you think that homeownership builds wealth, so you want to start early in life, and what you need and want (and can afford) when you are in your 20’s or 30’s, is typically much different than what you need and want (and can afford) in your 40’s, 50’s, or 60s. Studies have shown the average tenure for home ownership is 8 years, so over a 50 year period, a person will on average inhabit 8 houses.

Here’s where it’s broken:

Starter Homes

The first rung of the ladder is the starter category. Smaller and less expensive properties. Affordable.

There was a time pre-covid when there was a pretty ample supply of smaller houses that might be attainble to the average first time homebuyer, or even small attached housing such as condos and townhomes.

This is a 3 bedroom/1 bath house with a huge detached 2 car garage in Ruby Hill that a buyer of mine bought in 2018 for $309,000 using a low down payment and 1st time buyer grant. Low interest rate of course, I don’t know off hand but the intial rate was likely 4% or lower and no doubt a refinance occurred later on to an even lower rate.

Condos

A Condominium is also a common first step on the property ladder in a city. Very few new condo buildings and thus condo units were added since the last housing crash. In fact, if you look around Denver you may notice lots of larger buildings and cranes over the years, well, those were mostly all apartment buildings that are rental units. Very very few for sale condo buildings were built. One of the reasons for this is construction defect litigation. In essence, a developer and builder incurr significantly heightened risk of an HOA bringing a lawsuit against them for defects in this state. This adds tremendously to the cost and risk of developing, so developers who might have considered building a condo “for sale” building instead built rental buildings. And, it worked well for them, as the demand for these urban, luxury apartments has been voracious with Denver’s robust migration rate of young workers.

Starter Home Supply Constrained

With little new condo construction, very little “starter home” inventory has been added. Starter single family homes are not profitable to build and thus there is no new “starter home” single family homes added. The supply of available and affordable small, starter homes became incredibly constrained (vs. demand) and thus the market forces pushed these prices up (low interest rates also let prices run wild since it created more buyers and also those buyers can pay more) to the point where they are not affordable anymore to the average buyer.

Here’s an example of a “brand new” starter home in Denver’s Central Park neighborhood.

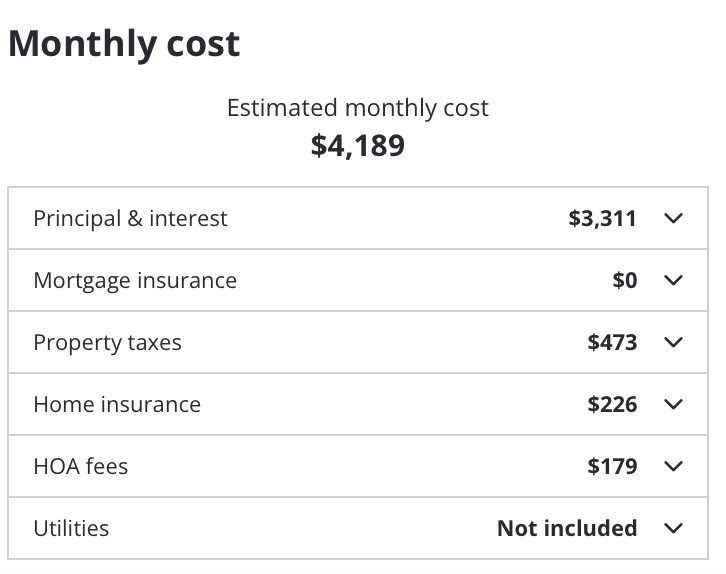

This house is 3 bedroom, 3 bathroom, at 1,380 sq ft. It’s actually a really cool small house- I really like these, except for the price. This house is priced at $645,050. Assuming a 20% down payment (i.e. $129,000 plus closing costs) here’s what your mortgage would look like:

This house is 3 bedroom, 3 bathroom, at 1,380 sq ft. It’s actually a really cool small house- I really like these, except for the price. This house is priced at $645,050. Assuming a 20% down payment (i.e. $129,000 plus closing costs) here’s what your mortgage would look like:

This is absolutely ludicrous. As you can imagine, these will be very hard to sell moving forward. These homes might have made sense a few years ago for some people when they were $495,000 @3% mortgage rates.

And, it’s even possible the builder doesn’t even have a huge margin on this house. The cost the builder paid for the lot, the escalating cost of construction, permitting, carrying costs at escalating rates, sales staff, etc. etc.

It’s just less risky and more profitable for the builder to build fewer, but bigger and more luxurious houses.

New Landlords

The share of investors who have gobbled up starter homes over the last few years has been highly elevated, mainly due to the distortion in the market the Federal Reserve created. It actually encouraged investors of all sizes to acquire Real Estate over other paper assets, thus stealing inventory that may have gone to an owner-occupant.

Affluent people had more money during Covid. With borrowing rates at rock bottom, people were not able to get any return on their capital parked in a bank. In fact, they were losing money with inflation at 10% there for a while. On the flip side, Real Estate in Denver was going up 10+% per annum, and low-rate mortgages for investment properties were super easy to get if you had a down payment. The Fed was buying mortgage backed securities and they loved investor loans just as much as owner occupant loans so basically our own government was helping to distort the market for starter homes (you could call this the law of unintended consequences) by blowing the price bubble and making it harder for owner occupants to buy one.

First Rung is Broken, next rungs are stuck

With the first rung broken, the second or third rung of the ladder is also suffering. If you are in a starter home and want to “move up” you need someone to buy your starter home at these really elevated prices in order to afford the next rung, which has equally gone up in price. Compounding that, the next rung doesn’t have much inventory as those people cannot move up either. People on that second rung may be stuck because while they may want to move from their second house into that “forever” house, they just cannot afford to move up at current prices and rates.

Solution

The logical solution is going to be for the free market to take over, and the market has a way of working it out. People will leave Denver and Colorado for locales that are more affordable and with more opportunity. Some people who opt to stay may never be able to purchase a house. Or, there will be a massive crash that will force investors out, reset prices, and restore equilibrium. What’s clear to me is that the current situation is not healthy or sustainable.

Jeff, our new supply is obviously very constricted, especially in the codo sector. Colorado’s stringent construction defect laws impose significant liability on developers, making it financially risky to construct condominium projects. These laws have resulted in higher insurance premiums and increased litigation, deterring developers from pursuing condo construction.