February 15, 2023

🚨The average 30-year fixed mortgage rate jumps back to 6.75%.

That’s a new high mark for 2023. pic.twitter.com/J9NgjuQ457

— Lance Lambert (@NewsLambert) February 15, 2023

The average rate for a 30 Year Fixed Rate Mortgage (Conforming Amount) is at a high now for 2023 after making a fast move up from near 6% to 6.75% over the past few weeks.

After these rates peaked at over 7% in October 2022, closer to 7.5% actually, many in the real estate industry thought, or “hoped” is more like it, that rates would continue their descent into the 5’s% which might have served to strengthen confidence for buyers and put a floor under the descending prices.

Mortgage Rates are not arbitrarily set by some high power; they do not operate in a vacuum. The mortgage rate available is a function of what the 10 year US Treasury yield is, plus a margin. As an example, as of the time of this writing, the 10 year yield is 3.875%.

The margin from 10 year yield to available mortgage rate is around 250-300 basis points or 2.5-3%, so rates available to a consumer today using this formula would be mid-high 6%’s, or a real rate of 6.75% (on average) for a par rate with no points.

What would cause the 10 year yield to go down?

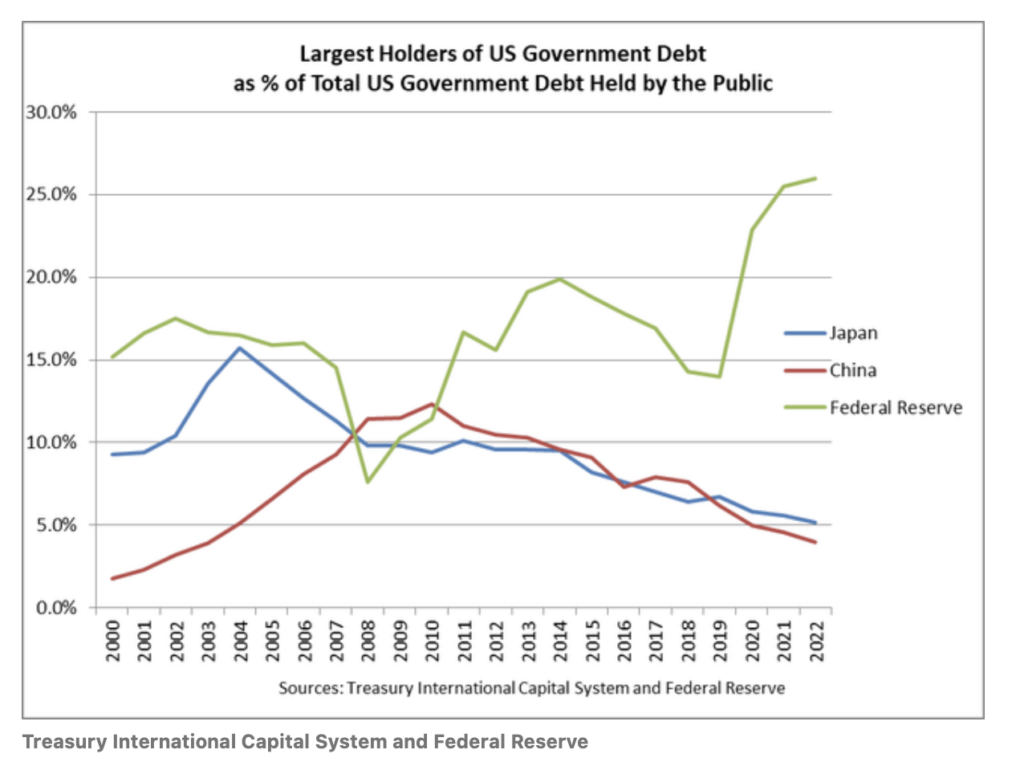

Increased demand for 10 year Treasuries would cause the yield to go down. With demand goes up, the bonds trade at a lower yield. Conversely, with little demand, yields need to rise to entice buyers. It’s important to understand that the biggest buyer of these bonds in recent years was the Federal Reserve itself, and starting in 2021 the Fed started to taper or scale back the scope of its bond purchases, and then this past Spring, stopped purchasing altogether. Additionally, the second largest buyer is foreign governments who in general are lessening their net purchases of US Bonds.

Remaining groups of buyers are US Financial Institutions. Large players are stepping away and yields are unlikely to go down, at least in any meaningful way, in the short term (barring a catastrophic event or similar financial crisis).

If 10 Year Treasury Yields Rise, So Will Mortgage Rates

When you understand how these two are linked, then it is hard to fathom mortgage rates falling much (besides normal vicissitudes in the market) during 2023, and likely will end the year higher, possibly much higher.

What do the financial experts predict for 10 year yields for 2023?

It’s a bit of a mixed bag for what the finance companies and economists predict will happen to yields in 2023. Some believe that at the end of 2023, yields will be in the mid to high 3%s (we are already at 3.875% on February 15, 2023); while others have predicted yields will continue climbing and be more in the 4.5-5% range by year end.

We could easily touch 8% for a 30 year fixed rate mortgage this year.

All the pieces are in place for yields to rise, and for mortgage rates to move in lockstep.

If you are in the market to buy property in the spring, be tight with your budget, know your numbers, partner with a good loan officer and broker. If you got prequalified in the past, get updated loan estimates from your loan officer. A lot has changed in 6 months.

Leave a Reply