It seems like there’s nothing for sale

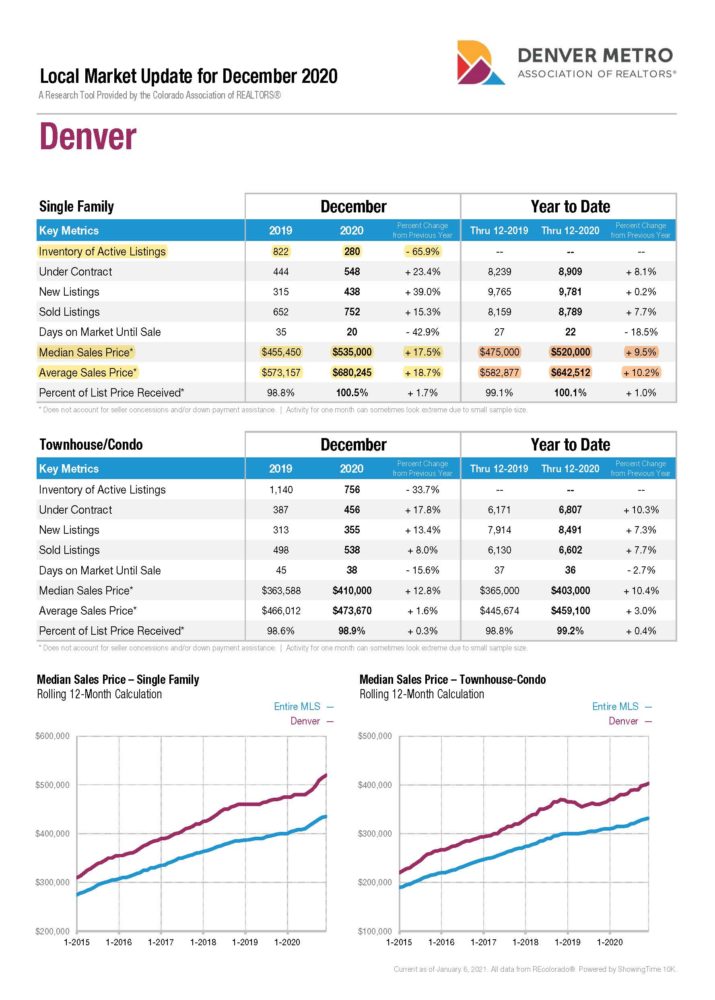

The inventory in the Denver Metro Real Estate market has been so tight, there has been such as shortage of homes for sale it seems, that many are questioning where all the houses are that should be for sale? In fact, in our last blog post, we mentioned that inventory year over year for December is down an incredible 65.9%.

It’s very frustrating and disheartening for Buyers in this market, and also for brokers who work with buyers in this market, when it feels like there is nothing for sale. It’s a terrible feeling when you want to buy an abode, you have done your homework, you are ready, you have all your ducks in a row, you have spoken with a lender and even have gotten pre-qualified, you have worked towards that, and there still seems like there are few homes being listed. It can make people angry; Sellers need to sell their houses! Why are they squatting on their properties, when there should be that normal market activity, that normal ebb and flow of houses changing hands?

Housing Market Stays Tight as Homeowners Stay Put: Supply crunch pushes prices near record highs

A recent article in the WSJ, title and link above, opines that people are staying in their homes longer on average. This could be by choice, or in some cases by necessity.

Not selling By Choice: Older, established owners with equity, who live in “forever” home already

An example of “By choice” would be middle-aged people who live in homes that are suitable for their needs, they have no plans to relocate away from the Denver Metro area, and they either have a fantastic interest rate through refinancing in the last few years, or perhaps they own their house free and clear. Older homeowners tend to own their homes a long time and that’s not a new phenomenon. “By Necessity” would be people who I would term “Move Up” buyers.

Not Selling by Necessity: Move-Up Buyers

If a person owns a condo or starter home, and is now ready for the next step on the property ladder, there are very few options for moving up. Most people cannot qualify for two mortgages so those move up buyers are forced to offer on a replacement property with a “contingent” offer. A contingent offer is an offer that is contingent on the offering party’s Home Sale contingency. Few Sellers want or need to accept an offer with a home sale contingency, so the entire segment of move up buyers are kind of stuck in limbo. There are some workarounds for these move-up buyers such as selling their current house first and renting short term, or getting a co-signor or bridge loan. These options are usually too complicated for all but the most aggressive people. Thus, these move-up buyers are stuck in place, and their homes, usually entry-level properties or second rung properties, are not coming to market the way they traditionally would.

Forbearance + Distressed Sales

A normal piece of inventory in any market is distressed sales. People are forced to sell their homes due to death, divorce, and financial distress among other things. The Federal Government’s mandate that lenders could not begin the foreclosure proceedings against any homeowner with a government-backed loan (government-backed loans make up the vast majority of ALL mortgages) if that homeowner requested forbearance (pause in payments). While this program has its merits to be sure, it has also caused homes that would ordinarily come to market in a functioning market economy to remain on the sidelines with owners living mortgage-free in said property. In fact, overall NEW LISTINGS in Denver for 2020 were only down around 4% year over year, and it is estimated that loans in forbearance to be in the 5-8% of all mortgages range.

But Wait, Are there really fewer properties for sale!?

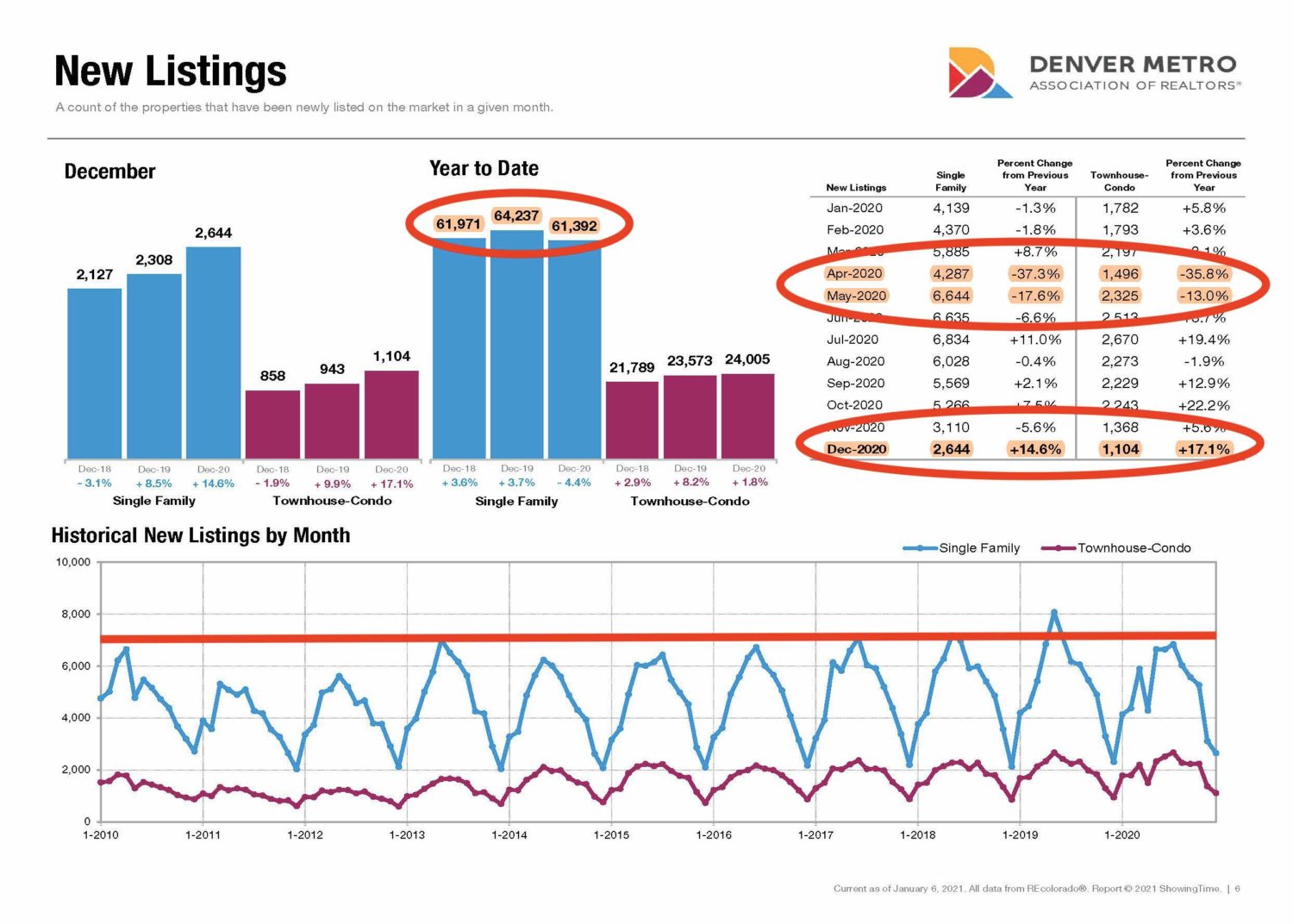

Here’s where it is interesting. The Denver Real Estate market is remarkably consistent and predictable, at least as it related to NEW LISTINGS. Do not confuse NEW LISTINGS with active listings. Active listings are what is available today to buy, and active listings as mentioned above are down approximately 68% for this past month on a year over year basis. Every year produces virtually the same number of homes listed for sale, with a small margin of variance, and 2020 was no different.

Simply put, the New listings in December of 2020 were actually UP about 15% from the previous year 2019, a non-Covid year. Additionally, the overall amount of New Listings in 2020 was 61,392 houses, almost identical to the year 2018 when there were 61,971.

Thus, we do not really have a New Listing Problem or an inventory problem per se, we have a demand problem, an over-demand problem! **The one caveat to this statement is that with a growing population like Denver has, ideally our new listings total every year would be going up in percentage each year commensurately to the growth rate of population. However, these graphs serve to illustrate that the inventory problem isn’t as simple as some would make it seem. We do have inventory, nothing has changed there. Historically, inventory hasn’t changed.

Over-Demand Problem

There are too many buyers for the amount of houses we have, plain and simple. Where is this extra demand coming from? Why has demand ramped up so much from last year for instance.

Interest Rates

Artifically-low Interest rate policy distorts markets and it’s doing this in Real Estate just like the Equity markets . For one, it encourages normal retail buyers, owner-occupants, to buy. The low rates entice people to buy when they would ordinarily be ok to rent, because with higher rates, homeownership “seems” more expensive. With low rates, savers earn no return on their cash. Thus older savers are more inclined to invest in rental properties to achieve some yield. This could be mom and pop investors buying a rental property or two, or investing in large REITs (Real Estate Investment Trusts) who own apartment buildings or in some cases massive portfolios of single family homes.

Demographics

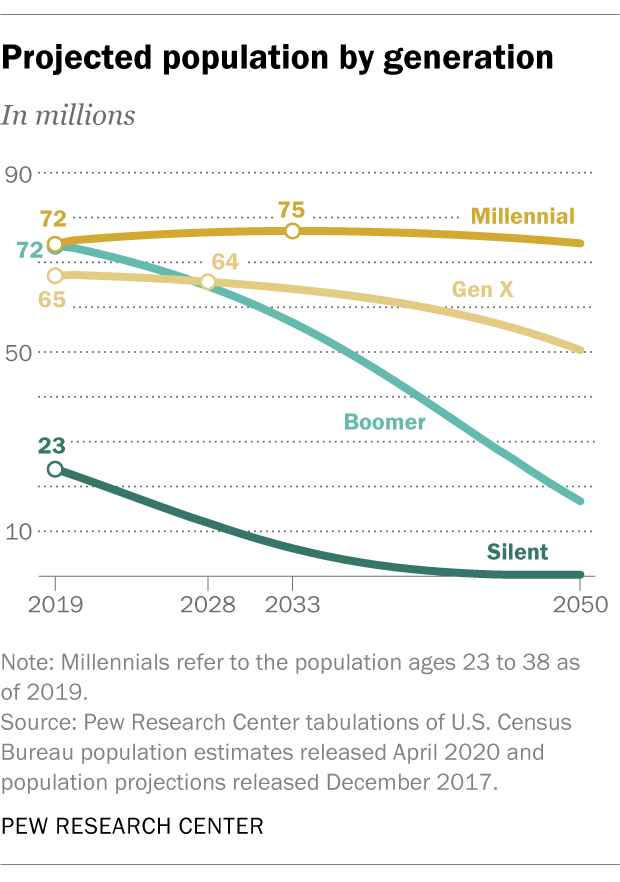

There are two cohorts of buyers out in massive force and given their sheer numbers, they are starting to move markets. The Millennials, born 1981-1996, are now aged 25-39. In fact, millennials born in 1990 are the largest birth year of the group, meaning millennials aged 31 right now are the biggest group of millennials within the cohort.

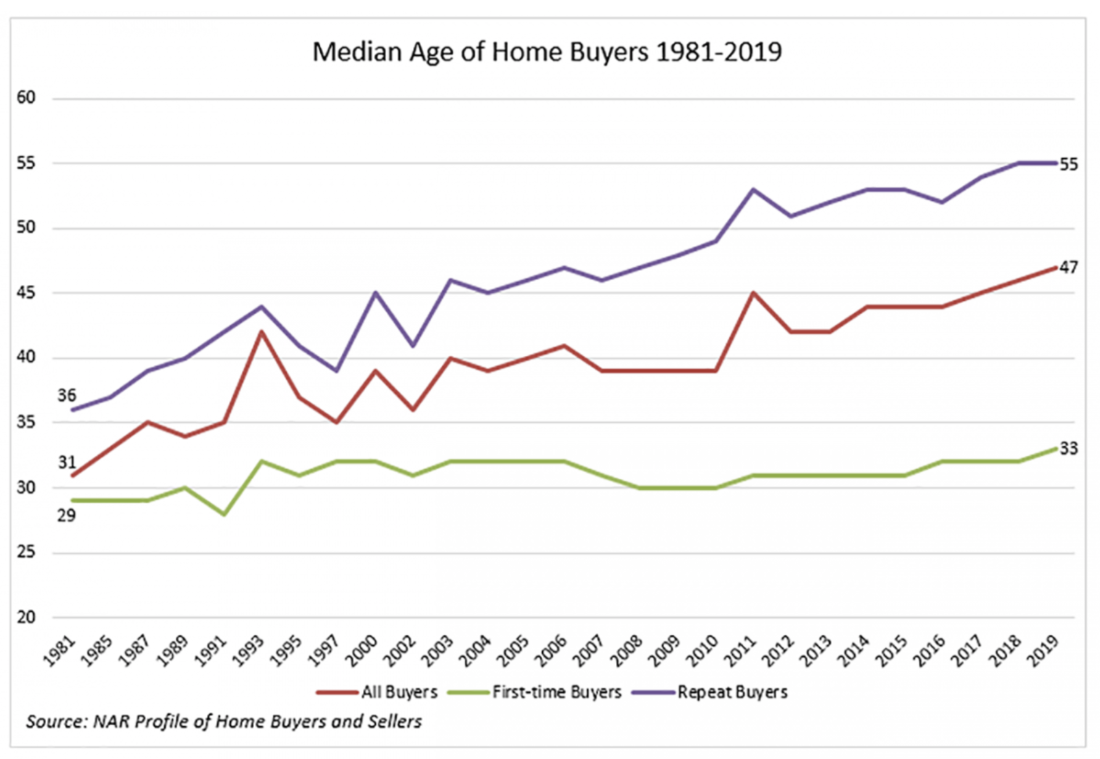

According to data from the National Association of Realtors, the average age at which people buy their first home has risen, and is currently around the age of 33 years old.

I could not find a recent and good graph from 2020 on the current homeownership rate for the overall millennial cohort, but it is believed to be less than <40% homeownership rate currently, whereas the overall homeownership rate of adults is around 67.9%. Again, in the simplest terms, millennials are now at home-buying age and a large percentage of this massive cohort has not yet purchased property, but has the desire to, and is beginning to in greater share numbers.

Boomers

Baby Boomers are the second largest cohort of people in this country, behind millennials. Born post war starting in 1945-1960, boomers are retired or entering retirement age. Denver, and Colorado at large, is considered a top place to retire given its weather, lifestyle, and low tax climate. While people historically tend to migrate less the older they get, boomers retiring to a totally different state is increasingly common compared to their parents generation, who mostly aged in place, and Denver and Colorado is capturing a large chunk of this “retirement migration.”

Conclusion

Denver needs additional housing inventory each year moving forward (in addition to the normal average amount of annual new listings). In a future post we will go into some of the challenges and impediments to adding new supply (i.e. new housing units) into the overall supply. New supply does not get added quickly, whereas population can grow quickly, and demand of existing population combined with new population can ramp up and down quickly with market conditions.

With a slow-adapting supply, and a rising demand, we feel Real Estate is a solid and wise investment long term in the Denver market.

“Buy Land. They aren’t making it anymore.” -Mark Twain

Good article Jeff! I’m thinking Realtors could help open up some sales, by helping potential sellers see the value in selling this spring. Beyond 2021 is uncertain, and they can get the best price ever. Sellers needs someone to go and that to me is likely the number one reason for no sales. Some of them could move and work remotely? But still, if the Realtor is a miracle work at helping them move on and relocated, they might do it. You have to believe a lot of home owners would love to sell with prices racing upward. Some will hold on for another 15% gain, but they should be talked out of that risk and just get on with their lives. Have you seen growth in interest from people relocating due to work from home?

Hi Gord, I haven’t personally met anyone yet who moved to Denver from say, the Bay Area, or a higher cost of living city, working a remote job; however, I have heard of many examples of people moving to some of Colorado’s mountain communities for that reason. I do believe cities such as Denver and Austin, TX will benefit from an influx of tech workers from higher cost locales who are seeking a certain lifestyle at a better value.